They’re maximizing awareness and visibility across key thematic areas, allowing them to reach customers earlier in the buying process and develop name recognition weeks if not months before someone ever needs their widget.

In content + SEO/GEO, this translates to topic saturation or market coverage. And it can also help create a defensible moat that keeps scrappy upstarts at bay.

Here’s how to create a Growth Gap analysis to understand how big competitors got so big, what you can learn from them, and how you can eventually close this gap to transform your brand into a market leader as well.

Step #1. Identify your “Growth Gap,” or the distance from market leaders you need to close ASAP

So what is a “big” site exactly?

It’s situation-dependent.

Meaning: it’s based on the actual direct or indirect competitors you’re most likely to bump up against across customer acquisition channels.

Let’s put some numbers around it, and show you how to benchmark your own progress properly to identify what your Growth Gap is and how you would go about closing it over the long haul.

We recently analyzed this Growth Gap for a site going up against a market leader.

So the following is real data, however, we’re purposefully trying to anonymize the two sites to hopefully not give everything away.

You can start this process by opening up Ahrefs and simply comparing a few high-level metrics against each.

“You” in the column below would represent the target site we were analyzing, while “Competitor 1” is just that – the market leader. Here’s how the two stack up:

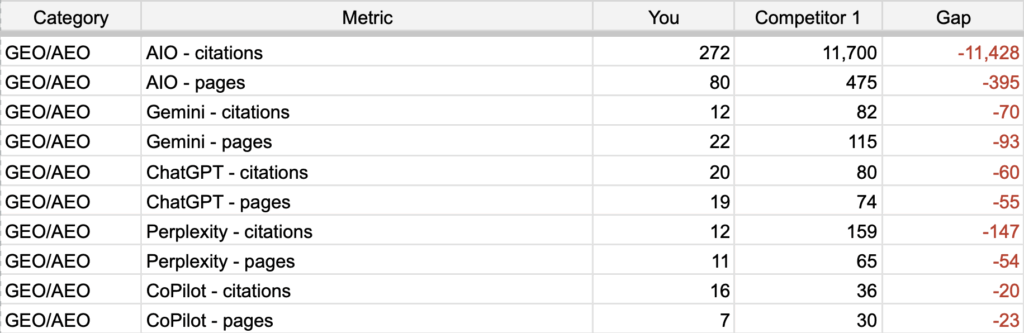

As you can see, there’s quite some distance between these two competitors. So unsurprisingly, this overall trend carries through to GEO/AEO citations and pages, too.

Now. Ask yourself: Why is the market leader so much more dominant than the scrappy upstart?

Sure, they’ve been around longer. But that’s only part of it.

The underlying “input” that drives this disparity between the two sites will be revealed on the first line in the next screenshot below:

See?

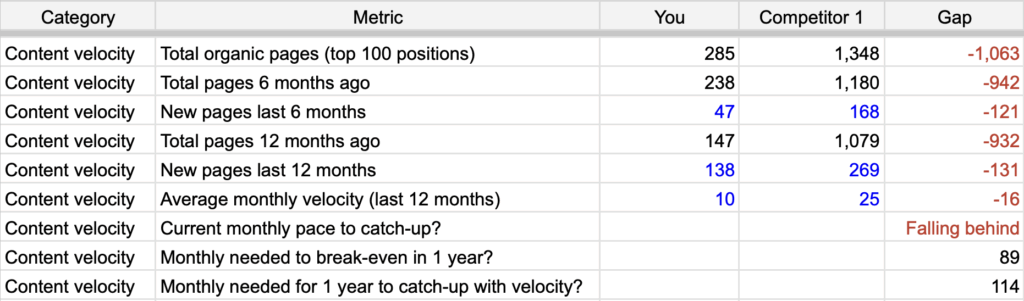

It’s actually pretty straightforward: “Competitor 1” has WAY MORE good content than “Your” site. AND, they’re continuing to outpublish the scrappy upstart at the same time.

<open_preachy_tone>

Please understand: There is NO WAY to build long-term search & discovery dominance without a combination of quantity + quality.

Sorry. Can’t happen.

All these LinkedIn marketing virgins that tell you otherwise are full of shit. Because if you’re going to actually develop the things that they claim LLMs prioritize — brand popularity, authority, customer relevance, etc. — then you’re going to have to still develop it through… drum roll please… content.

Of all kinds and sorts! Case studies, product pages, use case or vertical pages, support docs, resources or guides, blog articles, gated or ungated assets, research reports, paid landing pages + organic content pages to pick the same paid terms, and more.

OR, lots of paid. Or, lots of social. Or, lots of emails. Or, lots of events. Or, lots of outbound prospecting.

Or, most likely, a combination of all of these for several long, hard years.

The point is, you’re still gonna need to develop long-term brand visibility the old way. By rolling up your damn sleeves and doing some Fing work.

There is no way to grow eight, nine, or ten-figure+ revenues, pipelines, traffic value, or however else you want to analyze “success” in a large, competitive space without building a big site.

Because every single topic or keyword or citation that does actually drive results will already be overflowing with dominant, name-brand sites, too.

And building a big site yourself translates into lots of relevant, high-quality content over the long haul.

That doesn’t mean every single site needs 10,000 pages. Far from it. But it also means sitting on ~250 when your market-leading competition has ~2,500 ain’t gonna cut it, either.

</close_preachy_tone>

So. Back to the screenshot:

- There’s currently ~1,000 page content gap with the market leader,

- AND there’s an average production gap of at least 16 extra pages/month on average,

- That means if the scrappy upstart wanted to “catch up” and compete with this brand head-on, they’re going to need to figure out a way to publish ~89 pages/month to just break-even with the current site’s footprint in one year, or ideally…

- They’re going to have to publish 114 pages in the next year to keep up with the blistering pace the market leader is setting.

THESE are your inputs.

The raw materials that drive the total ranking keywords, overall traffic value, number of top three positions, GEO/AEO citations, etc.

Obviously, this is a tall order. We’re talking A LOT of content. In a very compressed amount of time.

Probably not realistic within the next year, even if you were about to go HAM with generated slop. (Which still wouldn’t be good enough based on the degree of complexity or accuracy for these topics.)

But that’s beside the point for now.

The traffic value gap estimate of $120,000/month does give you a starting point. That’s $1,440,000/year. That’s the estimated value of this traffic, as an alternative to paid channels.

Is YOUR search/GEO/AEO + content budget $1,440,000/year?

Cue Hyena laughter from the paid marketers with their 10x budgets at our expense. 🥲

Probably not. But it probably should be if you were in this exact position. Because a one-year payback period that delivers this sort of ROI would make ANY investor instantly happy.

So let’s assume you had some budget. Let’s assume you had the ability to create and publish ~114 high-quality pages each month for the next year.

As if these two things were easy enough to gloss over. 😉

How would you start trying to close this gap, or at least rein it in, to make your challenge something more manageable in the future?

Step #2. Identify obvious topic & ICP gaps that need prioritizing

If the market leader is big, and you’re small, then no – you don’t want to compete head-on today. No point in bringing a knife to a nuke fight just yet.

You can and should be looking to capitalize on arbitrage opportunities that they haven’t even thought about or considered yet.

However, at some point, if you’re going to be the Big Daddy in this space, you’re going to need to start laying the groundwork now that will help you compete directly head-on when the timing is right (most likely ~1-2 years from now).

‘Cause the bulk of that “traffic value” is probably locked away behind the top ~5-10% of actual top three rankings the market leader dominates.

However, unless your site is also big and well known, you have exactly a zero percent chance of gaining access to them currently.

Instead, start by answering:

- What are the top ~3-5 core problems your product solves?

- Who are the top ~3-5 ICPs or verticals and use cases for your product?

Now, you fire up a simple content gap audit.

You already know this direct competitor is sitting on tons of keywords and content you’re going to want eventually. You just need to figure out how to start pinpointing the low-hanging fruit you can use today to develop a successful Beachhead Strategy.

The trick here, though, is to look at these more holistically for now as broader themes that might relate back to your “core problems” or “ICPs” answered above.

Look through these individual keywords, paying more attention to the broader themes, potential parent topics, etc. and then considering the nerdy SEO metrics:

- Highest performing top 3 positions

- Primary parent topics by volume and quantity (or number of related terms)

- Biggest relative CPC ranges that indicate where commercial intent leans

- KD ranges (so you can eventually set “caps” for the max ranges you’re comfortable with for now).

When you look at the screenshot above, you’ll notice a lot of “green card”-related keywords near the top. Checking it out as a parent topic unsurprisingly reveals… it’s pretty popular!

- The good news: there are LOTS of topics around this “core problem”!

- More good news: there are lots of different content types (news, evergreen, BOFU, etc.).

- But the bad news: there are also LOTS of topics around this “core problem”! (Where TF do you start?)

- More bad news: the biggest or most obvious ones are competitive AF.

So. Here’s what to do next.

Step #3. Analyze existing coverage or saturation of these topics to find the gaps

If you check out our AI Tools Topic Report, you’ll see an example of how to analyze a giant topic category like this (47,129 keywords across 98 term groups to be exact).

The goal is to organize them all into actionable decisions to figure out how to sequentially order the work.

That’s a mouth full.

But basically I mean: What topics should you target right now?

This month. And then, what about next month? And then next quarter? Ad infinitum.

To develop quick wins over the next few months, setting you up to achieve success on more strategic or commercial-leaning topics, while also developing long-term market dominance.

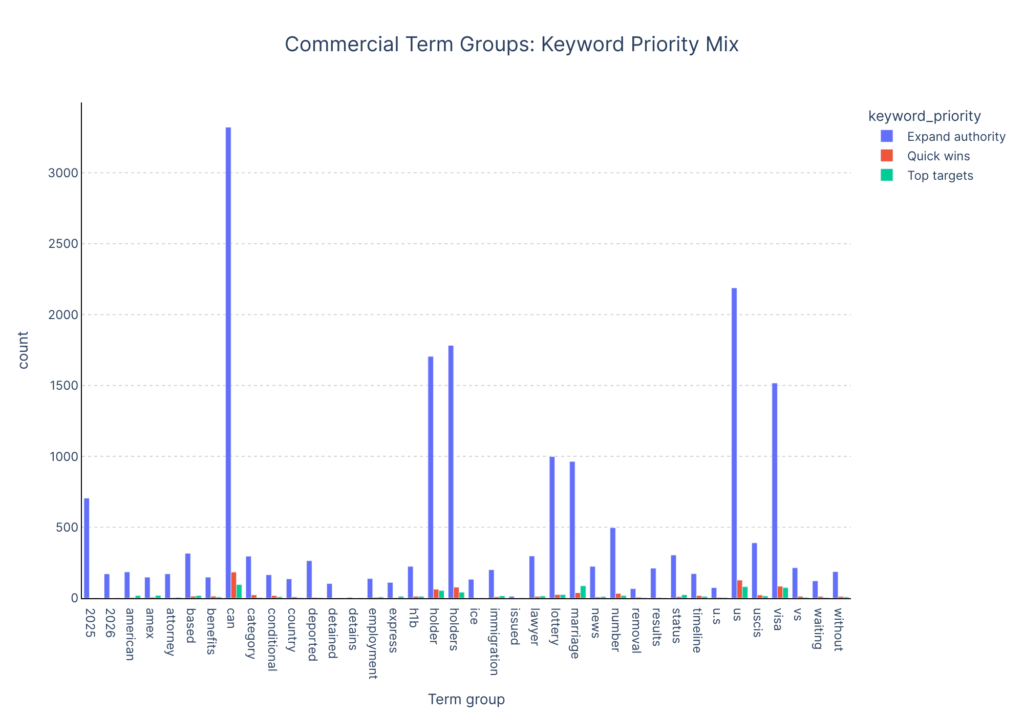

We’re breaking down “term groups” like this that are typically dozens (if not hundreds or thousands) of highly-related topics or keywords around a central theme.

Then, you use an analysis like this to answer five key questions:

- Which term groups have the highest potential value for your company to start?

- How can you “categorize” that value – from “quick wins” to “commercial” intent or even “awareness” and visibility?

- Which specific keywords, within each of these term groups, should be the highest priorities (and why)?

- How should you go about creating an overarching strategy to evaluate, target, rank, and get results from those keywords?

- And then how would you prioritize a potential 12-month content program to drive long-term results in this topic category?

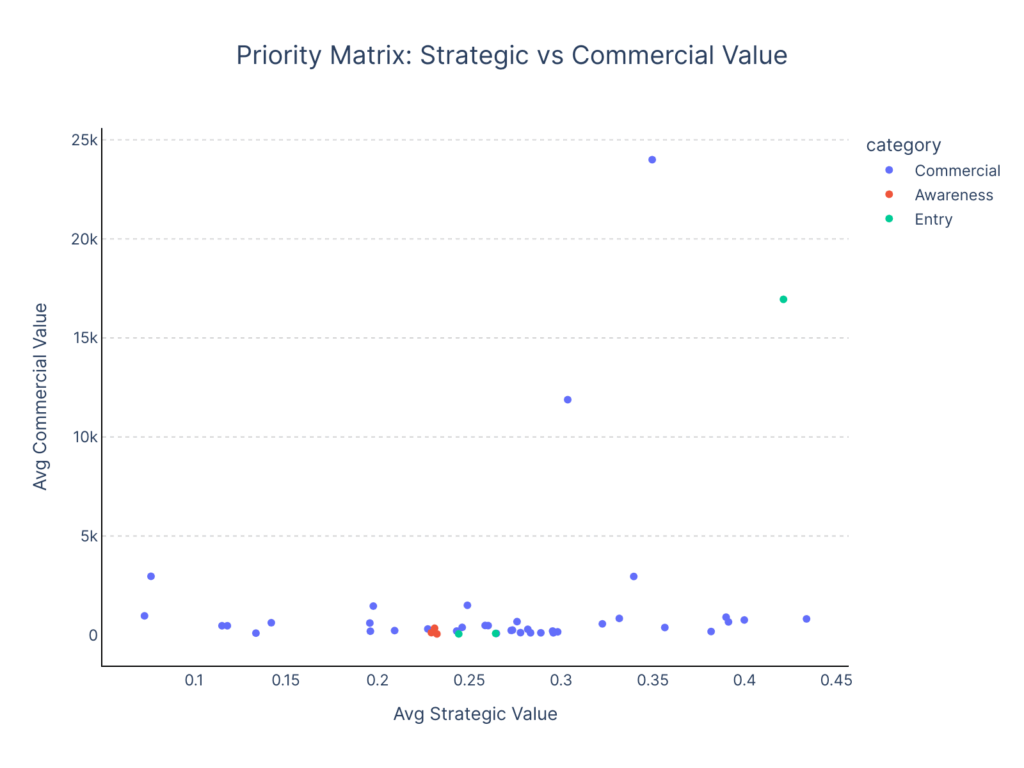

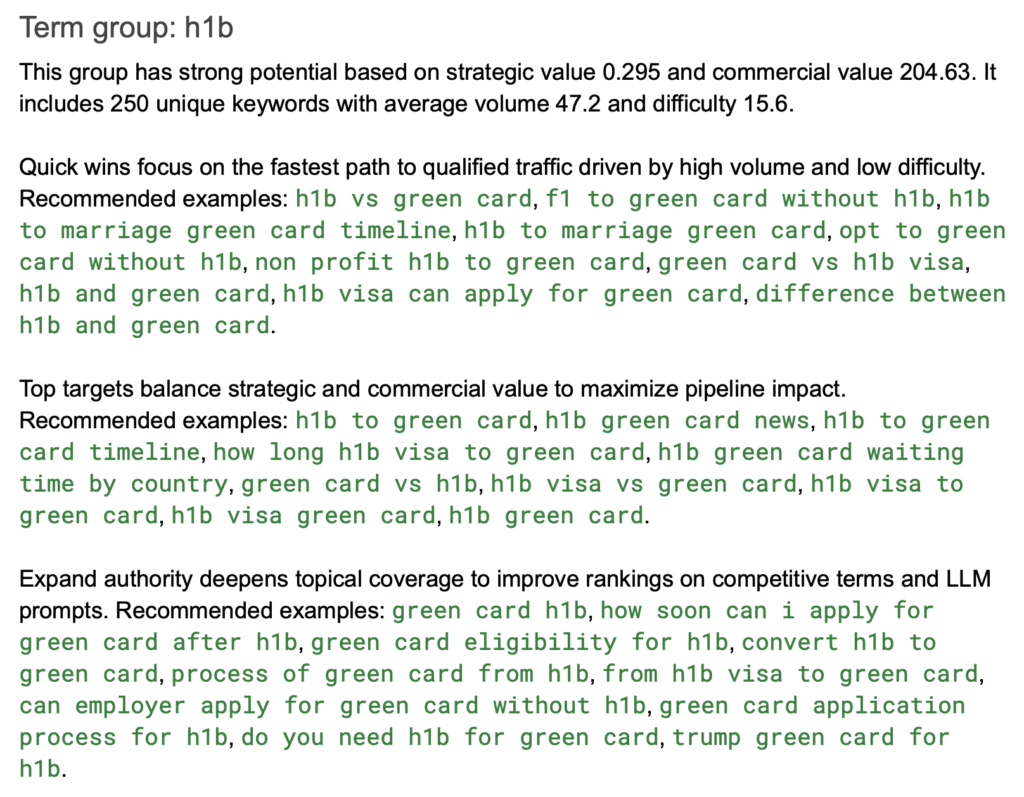

We use a combination of blended keyword data to start, including search volumes, keyword difficulty, cost-per-click (CPC), and projected growth rates. Then, we created weighted scores based on different percentage ranges to assess the overall “strategic value” and “commercial value” for each keyword.

Obviously, this example output I’m about to show you is a “generic” starting point for the green card space overall.

Not all of these will be a high priority for each site. You can and should disregard or ignore or skip over certain term groups simply because they lack relevance.

But here’s an example of how we would analyze the ~44k topics under “green card” as a starting point:

Next, we analyze the underlying keywords within each term group into: “Quick wins,” “Top targets,” and “Expand authority”:

Hopefully this is making sense. Yes, it’s a bit theoretical. However, it gives you a good 30,000-foot view of the entire landscape before you.

And it will help you better understand the potential areas of opportunity for closing all of these “gaps” we illustrated above.

For this specific example, let’s focus on one of the term groups in the middle of the chart: “H1B.”

Wikipedia is telling me that: “H-1B is a classification of non-immigrant visa in the United States that allows U.S. employers to hire foreign workers in specialty occupations.”

Ok. Cool.

Now, let’s look at the underlying keywords within this term group to start analyzing the best potential places to start:

Again, the actual way you (or we) might interpret these could be different. But it’s as good a starting point as any to develop your next steps.

So let’s look at two last examples.

First, we’ll “play offense” to prioritize net-new content to attack. Then, we’ll turn our attention to “playing defense” to make sure we’re continuing to reinforce these existing topics on our site so that a rising tide lifts all boats eventually.

Step #4. Play offense: Assess existing topical authority to predict net-new content priority

At the risk of oversimplifying: your ability to rank & drive results from net-new content is almost 100% reliant on:

- Your site’s size & strength (relative to the existing SERP competition), and

- Your existing topical authority across these terms.

(The first one is outside the scope of this article. I’m trying to somehow keep this thing under 5k words as it is. But there’s a reason we have a dedicated company for this, too.)

If we zero’d-in on the second, or topical authority, you can use tools like SurferSEO, MarketMuse, et al. to help put statistical numbers around this abstract concept.

However, you often don’t even need to go that far to get a quick assessment.

You just need to spot check existing page performance – including the number of unique pages already ranking for a certain number of related queries, and all of their respective ranking positions.

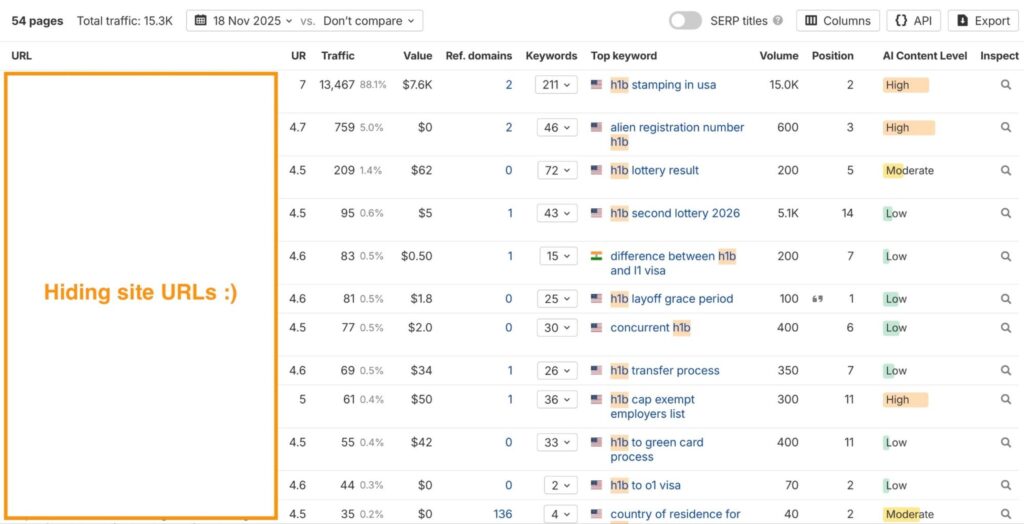

If we’re sticking with the “H1B” term group under “green cards,” then we can first look for “H1B”-related pages:

Then, we can repeat this for “green cards”:

Amazing. This tells us that we have a decent starting point to build on. There are a few dozen pages for each, with good ranking positions already.

Now, we can start grabbing those suggested keyword categorizations from the previous step, and drop those into some straight-forward keyword research analysis.

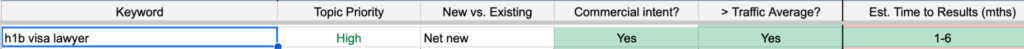

Make sure to add your target site to double check that there are no existing positions currently ranking to also rule out future cannibalization:

Awesome. The target site isn’t currently ranking for any of these “quick win” keywords we previously identified.

We have an internal model that helps us then personalize raw keyword metrics to better understand the potential impact and “time to results” (or getting first page rankings + traffic) for net-new content on an individual site.

If we focus specifically on the “H1B visa lawyer” keyword, we’ll confirm that this is indeed a great target for net-new content.

It’s highly relevant, no existing pages have any rankings for it, there is commercial intent, traffic volume checks out, and we think we can potentially get it to rank on the first page within ~1-6 months.

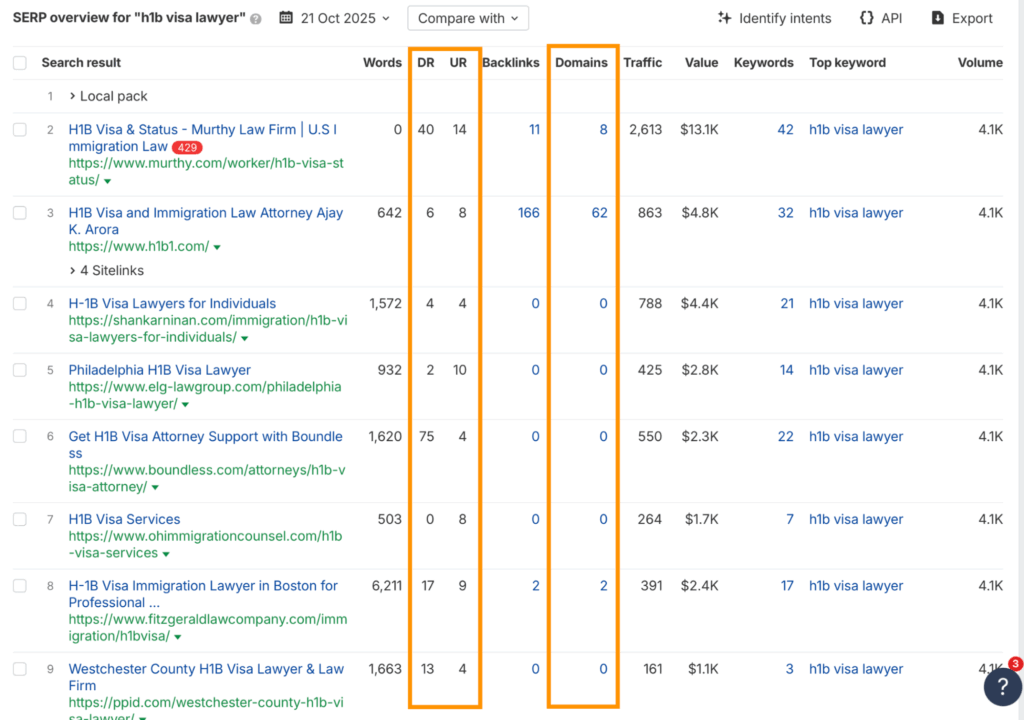

Next, we can confirm that our target site is within the competitive range of the existing SERP competition to make sure we feel strongly about shortlisting this target:

The overall brands currently ranking, their respective DR and UR ranges, as well as KD (quantity of referring domains needed) are all within striking range.

So this is an EXCELLENT net-new piece of content that should have been published yesterday. Or, you know, as soon as possible.

Now, if we know we’re going to be making a strong offensive push in this area for the long-term, we also need to make sure we don’t let existing content decay sabotage our efforts.

Step #5. Play defense: Update and expand existing, underperforming content

There are a few clues to look for to quickly identify “underperforming” content that’s ripe for updating, expanding, or overhauling.

The first is the current ranking positions.

When we audit existing content, we again use our model to help compare a bunch of underlying metrics to help “flag” the highest points of leverage.

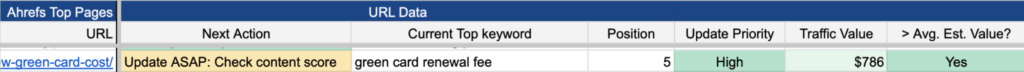

In the example below, you’ll notice that this site has a current position 5 for “green card renewal fee”:

Position 5 is good. But position 1 is better. Especially in a world of declining CTR’s based on AI Overviews. Thanks, Obama Google.

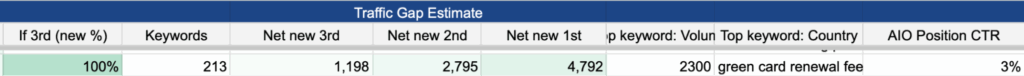

Now. If we WERE to update and improve this content to push it into the top ~3 positions ideally, even with declining CTRs, would the additional traffic gap be worth closing?

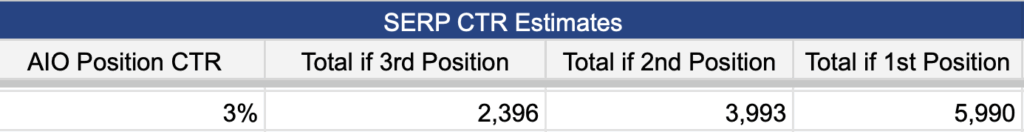

You can apply the adjusted AIO SERP CTR estimates for each position (thanks Advanced Web Ranking 🙏) to figure out the new potential traffic we could expect on this one URL:

Easy, right?

We can now shortlist this example (and others like it) to continue reviewing in more depth to determine IF it’s worth a bigger overhaul. And if so, what exactly would need updating and why.

Next, you should also keep an eye on content that’s most likely to lose ranking positions.

Specifically, zero-in on anything with high or heavy generative AI use.

Trying to use generated AI to write content to help you close this huge ~1,000 page gap ASAP is a decent bet. Especially for a small or newer brand.

BUT, once it starts ranking well (e.g. first page), it’s probably worth analyzing further to see if it needs updating before rankings and visibility fall off a cliff.

‘Cause it almost always does. Not a matter of if but when.

Ahref’s helpful “AI Content Level” under Top Pages is a good starting point to spot check all of these potential URLs:

Like before, we’re just trying to create shortlists at this point to further analyze each in-depth. So you can start with AI content that gets into positions 1-10, and then analyze the topic for product or ICP relevance, then volume and CPC and other common data points.

Again. You don’t HAVE to rewrite the whole thing. There might be no action required at this time, too.

You just need to review it and be critical to make sure it’s going to actually do a good job building trust and credibility with the people who land on it. Versus just picking up rankings or LLM citations for rankings or citations-sake.

This is the Traffic Recovery process that we recently went through with another client, resurrecting their AI content performance back from the dead after falling to page 6:

At this point we could go into LOTS more detail on the actual writing.

You know, the actual hard part in any of this analysis. The actual symbiosis of reader interest, brand credibility, SEO or LLM intent, etc. But again, a topic for another day.

Just don’t lose sight of the fact the primary aim of content — any content! — is to chase customer relevance, not tactics (i.e. the same regurgitated crap).

If you focus on the former, the latter usually takes care of itself long-term.

Conclusion

The best known brands in each space already have lots of brand awareness and visibility across relevant channels.

THIS is ultimately what drives the best ranking positions, the most LLM citations, and more.

It is significantly easier to drive better, faster results for a brand that’s already big (or in hypergrowth).

The good news is that you can also learn from them. You don’t copy their playbook. You can’t. It won’t work. At least not yet.

But if you know where to look, you’ll start picking up on trends and patterns that can show you the road to the promised land.

Starting with a simple Growth Gap can shed a spotlight. You’ll start understanding how or why they got so big and dominant in the first place. And you’ll be able to use that insight to plan a short, medium, and long-term approach that’ll get you there eventually.

If, and only if, the execution matches up.